All Categories

Featured

Table of Contents

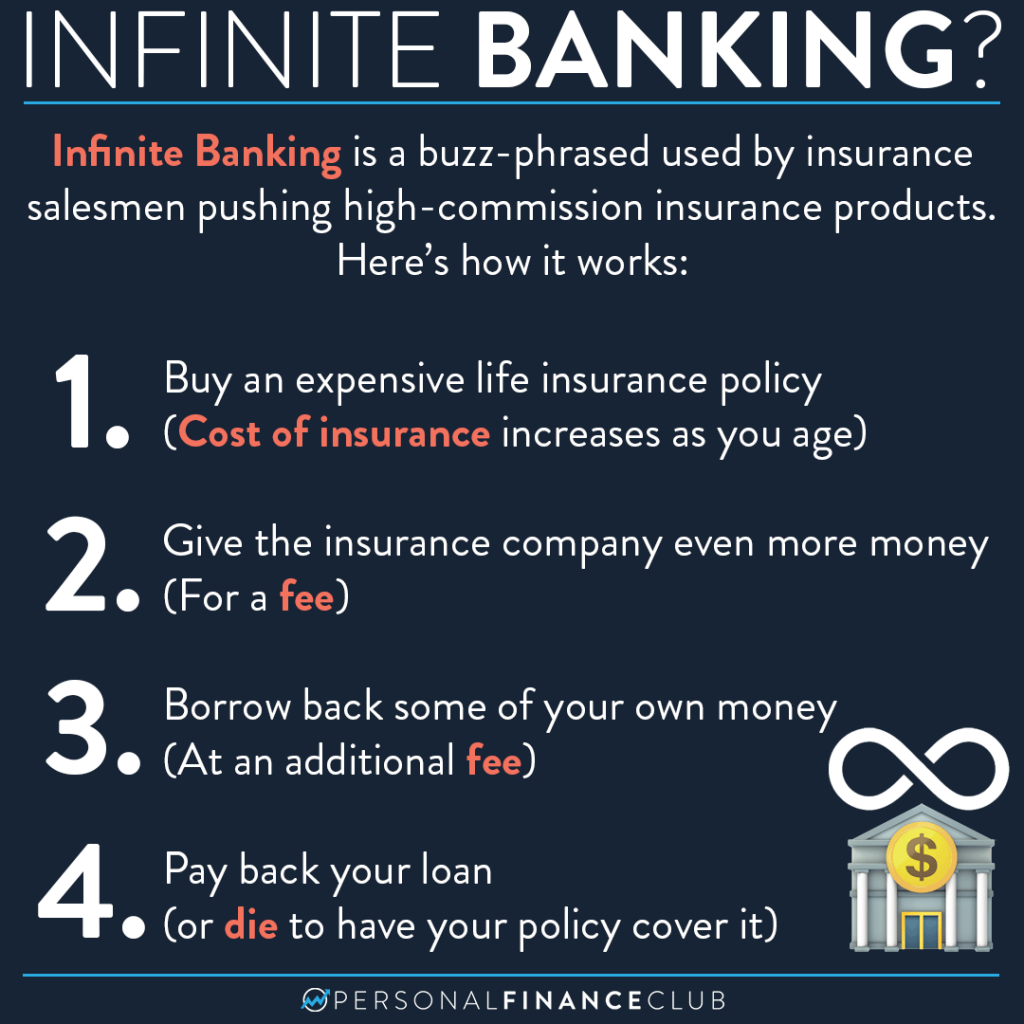

The approach has its own advantages, yet it likewise has concerns with high fees, intricacy, and more, resulting in it being concerned as a scam by some. Boundless banking is not the very best plan if you need just the financial investment part. The infinite banking idea focuses on the usage of whole life insurance coverage plans as an economic tool.

A PUAR allows you to "overfund" your insurance plan right approximately line of it ending up being a Customized Endowment Contract (MEC). When you utilize a PUAR, you quickly enhance your cash worth (and your death benefit), thereby enhancing the power of your "bank". Further, the even more cash money worth you have, the greater your passion and returns payments from your insurance policy business will be.

With the increase of TikTok as an information-sharing system, economic guidance and methods have actually located an unique method of dispersing. One such strategy that has actually been making the rounds is the unlimited financial principle, or IBC for short, amassing recommendations from celebs like rap artist Waka Flocka Fire - Cash value leveraging. However, while the method is presently popular, its roots trace back to the 1980s when economist Nelson Nash presented it to the globe.

Can anyone benefit from Cash Flow Banking?

Within these plans, the cash value grows based on a rate set by the insurance firm. Once a considerable cash value accumulates, insurance policy holders can obtain a cash value funding. These car loans differ from conventional ones, with life insurance coverage acting as security, indicating one can lose their protection if borrowing exceedingly without adequate money worth to support the insurance policy costs.

And while the allure of these policies is apparent, there are natural limitations and dangers, requiring persistent cash worth monitoring. The strategy's authenticity isn't black and white. For high-net-worth individuals or business proprietors, especially those utilizing methods like company-owned life insurance policy (COLI), the benefits of tax breaks and substance development could be appealing.

The attraction of infinite banking doesn't negate its challenges: Expense: The fundamental requirement, a long-term life insurance policy plan, is costlier than its term counterparts. Qualification: Not everyone receives entire life insurance policy due to rigorous underwriting procedures that can leave out those with specific wellness or way of life problems. Intricacy and risk: The elaborate nature of IBC, combined with its threats, might prevent several, particularly when less complex and much less high-risk alternatives are readily available.

What are the benefits of using Infinite Banking for personal financing?

Assigning around 10% of your monthly income to the plan is simply not practical for many individuals. Part of what you read below is just a reiteration of what has already been claimed over.

Before you obtain on your own into a circumstance you're not prepared for, recognize the adhering to first: Although the idea is typically sold as such, you're not really taking a lending from on your own. If that held true, you wouldn't need to repay it. Instead, you're borrowing from the insurance firm and have to repay it with rate of interest.

Infinite Banking is a powerful way to take control of your finances that allows individuals to use their whole life insurance policy as a financial asset.

Insurance brokers specialize in helping clients choose the right policy for Infinite Banking. Unlike traditional financing methods, Infinite Banking provides tax advantages, allowing policyholders to take control of their financial future. Learn more from a financial advisor to take the first step toward financial independence.

Some social media blog posts advise using cash worth from entire life insurance to pay down credit scores card debt. When you pay back the lending, a section of that interest goes to the insurance business.

How do I leverage Infinite Banking Retirement Strategy to grow my wealth?

For the initial several years, you'll be paying off the compensation. This makes it very hard for your plan to build up value throughout this time. Unless you can afford to pay a few to a number of hundred bucks for the next decade or more, IBC won't function for you.

If you call for life insurance policy, here are some beneficial pointers to consider: Take into consideration term life insurance. Make certain to shop around for the ideal rate.

How do I qualify for Life Insurance Loans?

Imagine never ever having to stress regarding small business loan or high rate of interest once again. What if you could borrow money on your terms and develop wide range at the same time? That's the power of infinite banking life insurance policy. By leveraging the money value of entire life insurance coverage IUL policies, you can grow your wide range and borrow cash without counting on traditional banks.

There's no set funding term, and you have the flexibility to decide on the settlement timetable, which can be as leisurely as repaying the financing at the time of fatality. This adaptability reaches the servicing of the financings, where you can select interest-only payments, maintaining the car loan balance flat and manageable.

What is Self-banking System?

Holding cash in an IUL taken care of account being credited rate of interest can typically be much better than holding the cash money on deposit at a bank.: You have actually constantly desired for opening your very own pastry shop. You can borrow from your IUL policy to cover the initial expenses of renting out a room, acquiring devices, and employing team.

Individual finances can be gotten from standard banks and credit report unions. Obtaining cash on a credit report card is normally extremely costly with annual percent prices of interest (APR) usually getting to 20% to 30% or more a year.

Latest Posts

Creating Your Own Bank

Infinite Banking Concept Dave Ramsey

Infinite Banking System Review